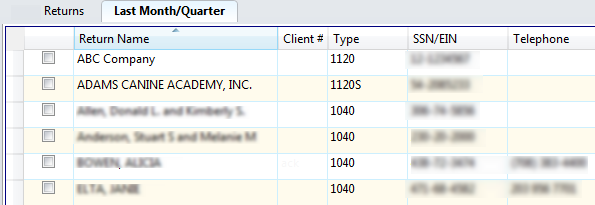

Last Month/Quarter Tab

The Last Month/Quarter tab in the Rollover Manager displays a list of all current year returns.

Payroll returns are not supported in ATX 2019. If you have not yet installed the 2019 W2 and 1099 or Payroll Compliance software, see W2-1099 or Payroll Compliance.

To view Last Month/Quarter returns that are available for Rollover:

From the Rollover Manager, click the Last Month/Quarter tab.

Last Month/Quarter tab

The following table details the columns and/or fields appearing in the Last Month/Quarter tab view:

|

Column/Field |

Description |

|---|---|

|

Return Name |

Name on the rolled over return. |

|

Client # |

An optional number that can be assigned to a client or customer, if desired. |

|

Type |

Return type, such as 1120 or 1040. |

|

SSN/EIN |

Social Security Number or EIN for the return. |

|

Telephone |

Telephone number listed on the return, if applicable. |

|

|

Email address of the contact for the return that's being rolled over. |

|

Address |

Mailing address for the rolled over return. |

|

City |

Residing city for the individual whose return was rolled over. |

|

State |

Resident state for the individual whose return was rolled over. |

|

ZIP |

ZIP Code for the individual whose return was rolled over. |

|

Preparer |

Name of preparer who prepared the rolled over tax return. |

|

Partner |

Name of partner, if applicable. |

See Also: